This week’s mid-point saw a reset in global markets, with Wall Street bouncing back from geopolitical jitters and a wave of sector-specific catalysts reshaping expectations across energy, fintech, and crypto.

Wall Street Rebounds as Middle East Tensions Ease

Markets regained ground midweek as geopolitical risk in the Middle East de-escalated. After a brief flare-up sent futures into a tailspin, investor sentiment recovered rapidly on news that recent strikes caused no casualties and backchannel diplomacy is progressing.

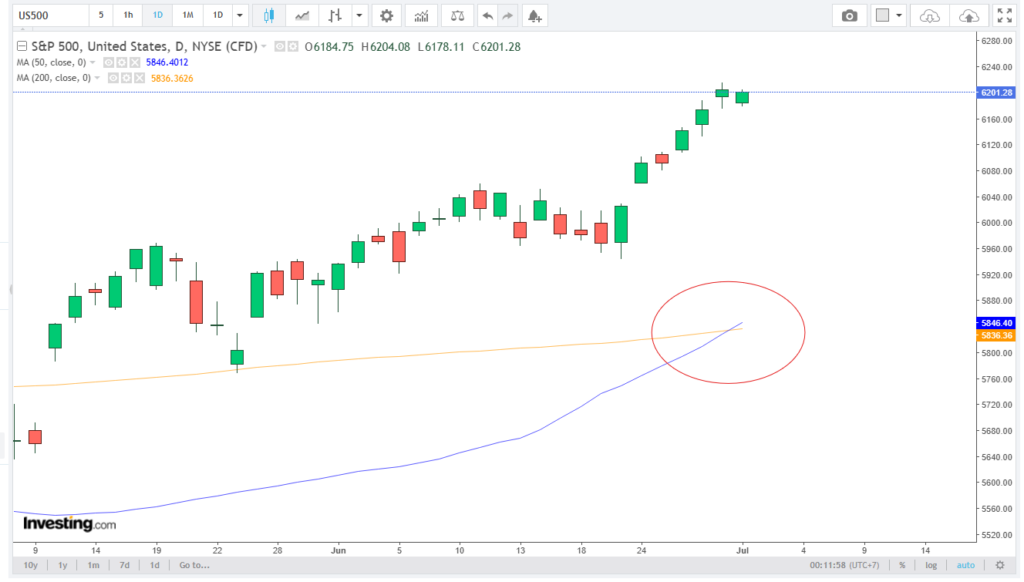

The S&P 500 gained 1.02% to close at 6,139, the Nasdaq rose 1.3%, and the Dow added 0.85%, with tech and energy leading sector performance. Notably, breadth improved: over 80% of S&P 500 constituents posted gains, a reversal from Monday’s narrow leadership.

Technically, the S&P 500 remains well above its 50-day moving average (now at ~6,030), and the formation of a “golden cross” last week (50-DMA crossing above the 200-DMA) supports the case for medium-term bullish continuation.

Brent Crude Volatile Amid Conflict and Supply Repricing

Oil markets saw wild swings, with Brent crude dropping 8% intraday to as low as $66/bbl before rebounding above $70.

Traders are balancing two opposing forces:

- Geopolitical risk premium, tied to Israel–Iran tensions and recent U.S. Navy deployments

- Structural oversupply, as OPEC+ production cuts unwind and U.S. shale output stays elevated

Technical indicators show Brent support at $66.20 (March lows) held firmly, while RSI divergence suggests near-term exhaustion in the selloff. Short-covering and options flows are likely to keep volatility high.

Stablecoin Shock Sends Payment Giants Lower

A new front opened in fintech this week after Amazon and Walmart were reported to be actively piloting stablecoin-based payment networks aimed at reducing reliance on Visa, Mastercard, and AmEx’s fee structures.

Following the reports:

- Visa (V) dropped 2.1%

- American Express (AXP) lost 1.8%

- Mastercard (MA) held flat but saw rising options volume on the put side

The broader implication? Retail-driven disruption in payments is no longer hypothetical—it’s accelerating. This also reignited debate within U.S. regulatory circles, with the FAA and Treasury expected to comment on stablecoin thresholds next week.

Crypto ETFs See Over $2 Billion in Weekly Inflows

Crypto capital inflows are surging again.

As of Wednesday:

- Bitcoin spot ETFs brought in ~$1.3B

- Ethereum ETFs attracted ~$800M

- BTC/USD is testing $113,000 resistance

- ETH/USD holds above $6,400

This is the highest weekly inflow since March, with traders rotating out of gold (which remains rangebound around $3,294/oz). On-chain data also shows increased accumulation from institutional wallets—a vote of confidence amid regulatory stasis.

China’s Ganfeng Lithium Boosts Supply by 50%

In commodities, Ganfeng Lithium announced plans to increase production output by 50% by Q4 2025 to meet surging demand from Chinese and European EV manufacturers.

The announcement lifted:

- Ganfeng shares +6.4% in Hong Kong

- Livent Corp (LTHM) +3.1% in NY premarket

- Global lithium futures +2.2% overnight

This marks a shift in lithium pricing expectations, with analysts now revising 2025 demand growth above 18%, challenging previous balance-sheet estimates that had assumed oversupply.

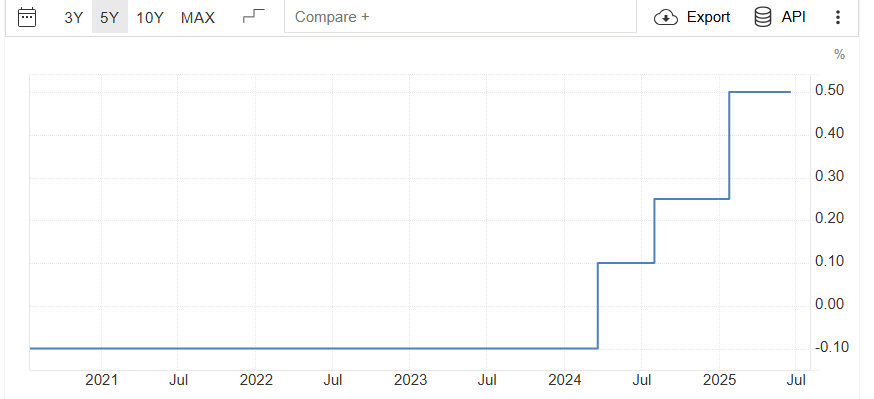

BOJ Holds Steady, Flashes Hawkish Signal

The Bank of Japan kept policy steady at 0.5%, yet signaled a cautious pivot. In their June meeting, they confirmed a slower pace of bond purchase reduction—cutting monthly JGB tapering from ¥400B to ¥200B starting April 2026. Governor Ueda emphasized that rate hikes remain on the table, conditional on wage and inflation trends.

Notably, hawkish voices like board member Tamura are calling for decisive rate hikes toward 1% to anchor inflation expectations. Meanwhile, BOJ policy is being shaped by trade-policy uncertainty—from U.S. tariffs down to global commodity pricing. Markets reacted by strengthening the JPY to ~144.5 and modestly increasing 10-year JGB yields to ~1.47%.

Final Take

This week’s dynamics are more than just noise.

From crypto’s asset-class maturity to oil’s price floor and a central bank pivot in Japan, global markets are flashing signals of rotation, recalibration, and renewed divergence.

Investors aren’t just chasing rallies—they’re preparing for regime shifts.

Stay ahead of the trends with CG FinTech Media Center — global insight for smart trading decisions.

Forward Looking Statement Disclaimer

This document contains forward-looking statements, which can generally be identified by the words “expects,” “believes,” “continues,” “may,” “estimates,” “anticipates,” “hopes,” “intends,” “plans,” “potential,” “predicts,” “should,” “will,” or similar expressions. Such statements are based on CG FinTech’s current expectations and assumptions, but actual results could differ materially from those anticipated due to a number of risks and uncertainties. CG FinTech does not guarantee the accuracy or completeness of these statements and undertakes no obligation to update or revise any forward-looking statements.

Disclaimer

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any financial instruments. Trading Contracts for Difference (CFDs) and foreign exchange (forex) carries a high level of risk and may not be suitable for all investors. It is important to fully understand the risks involved and seek independent financial advice if necessary.

Leave a Reply