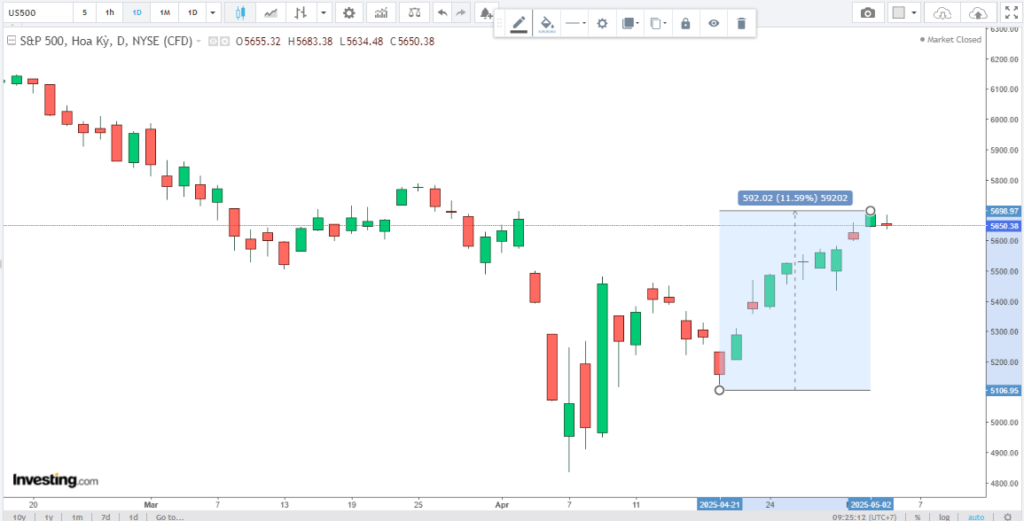

The S&P 500 snapped its nine-day winning streak on Monday, closing down 0.63% as investor optimism cooled ahead of key economic events. The Dow Jones Industrial Average and Nasdaq Composite also declined by 0.24% and 0.74%, respectively.

The pullback follows a historic rally, with the S&P 500 achieving its longest winning streak in over two decades.

Investors are now turning their attention to the upcoming Federal Reserve policy meeting and ongoing U.S.-China trade negotiations, both of which could significantly impact market dynamics in the near term.

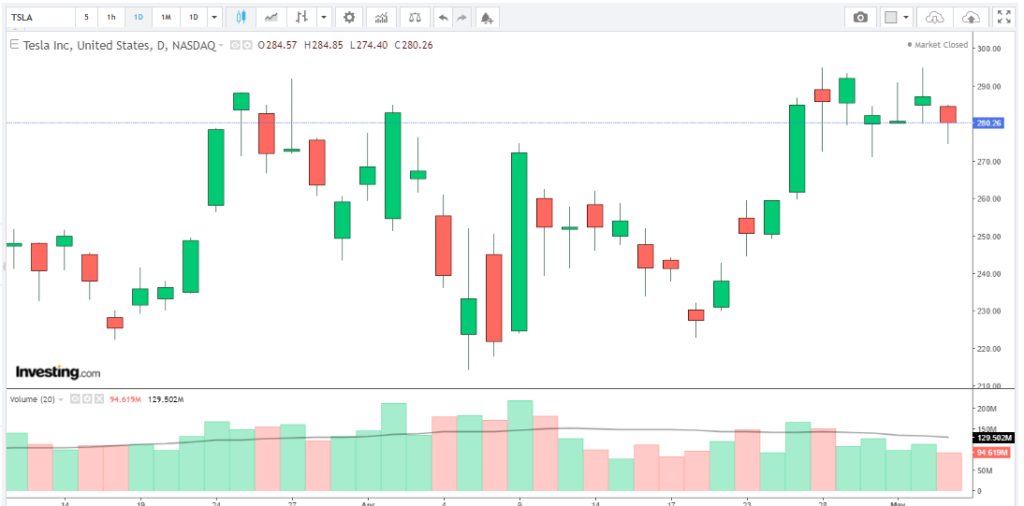

Tech Sector Faces Mixed Signals

Tesla Inc. (TSLA) shares declined by 2.36% to close at $280.44, reflecting broader market apprehensions. Meanwhile, IBM’s announcement of its new z17 AI mainframe garnered attention, with analysts at BofA suggesting it could underpin a strong sales cycle for the tech group.

Commodity Markets Reflect Investor Caution

Gold prices experienced a slight uptick, with the SPDR Gold Shares ETF (GLD) rising 0.03% to $306.88, as investors sought safe-haven assets amid market volatility. Conversely, oil prices retreated, with the United States Oil Fund (USO) decreasing by 2.55% to $62.37, influenced by concerns over reduced demand amid slowing economic growth.

Global Markets Await Key Developments

Asian stock markets were subdued on Monday, with Australian shares dropping after weak Westpac earnings dragged financials. Major regional markets, including Japan, China, Hong Kong, and South Korea, were closed for their respective public holidays, leading to thin trading volumes in the region.

Investor Outlook

As markets navigate a complex interplay of economic indicators, policy decisions, and geopolitical events, investors remain vigilant. The coming weeks will be critical in assessing the resilience of global markets and the potential for sustained recovery or further volatility.

Stay Informed with CG FinTech’s Media Center

For comprehensive analyses and the latest updates on global financial markets, follow CG FinTech’s Media Center. Our expert insights aim to equip you with the knowledge to navigate the complexities of today’s economic landscape.

Forward Looking Statement Disclaimer

This document contains forward-looking statements, which can generally be identified by the words “expects,” “believes,” “continues,” “may,” “estimates,” “anticipates,” “hopes,” “intends,” “plans,” “potential,” “predicts,” “should,” “will,” or similar expressions. Such statements are based on CG FinTech’s current expectations and assumptions, but actual results could differ materially from those anticipated due to a number of risks and uncertainties. CG FinTech does not guarantee the accuracy or completeness of these statements and undertakes no obligation to update or revise any forward-looking statements.

Disclaimer

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any financial instruments. Trading Contracts for Difference (CFDs) and foreign exchange (forex) carries a high level of risk and may not be suitable for all investors. It is important to fully understand the risks involved and seek independent financial advice if necessary.

Leave a Reply