The financial markets took a hit on Monday, as mounting concerns over U.S. economic growth, rising tariffs, and recession fears weighed on investor sentiment. Equities tumbled across the board, with the S&P 500, Dow Jones, and Nasdaq all posting steep losses.

Meanwhile, Bitcoin dipped below $80,000, extending its recent slide, as risk aversion overshadowed optimism surrounding President Donald Trump’s Bitcoin reserve plan and crypto regulatory stance.

Stock Market Sell-Off Deepens as Recession Fears Grow

- At 4:00 p.m. ET (20:00 GMT) on Monday:

- The Dow Jones Industrial Average lost 889 points (-2.1%)

- The S&P 500 fell 2.8%

- The NASDAQ Composite dropped 4%

Tech stocks led the decline, with semiconductor giants like NVIDIA (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) suffering heavy losses as fears of an economic slowdown triggered a sell-off in risk assets. Tesla (NASDAQ: TSLA) plunged over 15%, wiping out its post-election gains.

President Trump further rattled markets in a Sunday interview with Fox News, where he refused to rule out a U.S. recession this year, instead describing the current state of the economy as a “transition period” due to his trade and fiscal policies.

Bitcoin Falls Below $80K, Crypto Markets Follow Suit

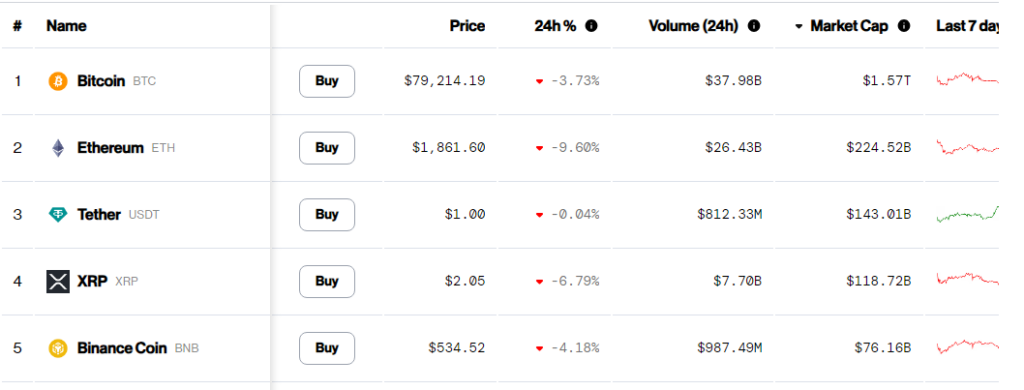

Cryptocurrencies mirrored the broader market downturn, with Bitcoin sliding 4.5% to $78,852 by 19:49 GMT.

Despite Trump signing an executive order to create a national Bitcoin reserve, investor sentiment remained sour, as recession fears overshadowed any positive developments in the crypto space.

Trump’s Bitcoin Reserve: Why It Failed to Lift the Market

Trump’s executive order approved the creation of a U.S. Bitcoin reserve, along with four additional altcoins – Ether, XRP, Solana, and Cardano – to be held as a strategic digital asset stockpile.

However, the plan does not include new government purchases of Bitcoin, at least not with taxpayer funds. Instead, the reserve will consist of confiscated crypto assets held by the Department of Justice.

While Trump has positioned himself as pro-crypto, the lack of clear buying measures left the market unimpressed. Even a White House crypto summit on Friday, attended by top industry executives, failed to provide concrete regulatory details beyond general optimism.

Forward Looking Statement Disclaimer

This document contains forward-looking statements, which can generally be identified by the words “expects,” “believes,” “continues,” “may,” “estimates,” “anticipates,” “hopes,” “intends,” “plans,” “potential,” “predicts,” “should,” “will,” or similar expressions. Such statements are based on CG FinTech’s current expectations and assumptions, but actual results could differ materially from those anticipated due to a number of risks and uncertainties. CG FinTech does not guarantee the accuracy or completeness of these statements and undertakes no obligation to update or revise any forward-looking statements.

Disclaimer

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any financial instruments. Trading Contracts for Difference (CFDs) and foreign exchange (forex) carries a high level of risk and may not be suitable for all investors. It is important to fully understand the risks involved and seek independent financial advice if necessary.

Leave a Reply