Global markets began the week on a cautious note as rising bond yields and hawkish central bank undertones pressured sentiment across risk assets. Equities drifted lower, cryptocurrencies remained volatile, and gold faced renewed selling pressure, all while investors positioned ahead of key U.S. data releases.

Equities Edge Lower on Risk Rebalancing

Major U.S. equity proxies showed modest weakness on Tuesday. The S&P 500, tracked by SPY, slipped toward 680.27. Tech-heavy QQQ, representing the Nasdaq, also eased to 617.17, while the Dow’s proxy DIA underperformed at 473.32.

The decline in equities comes as global bond yields moved higher, prompting a recalibration in risk appetite. With yields back in focus, particularly following signals from Japan’s central bank, investors appeared more reluctant to push equities higher without clearer macro guidance.

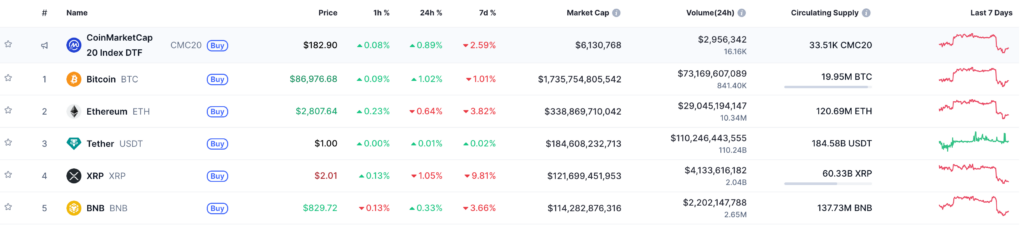

Crypto Markets Struggle to Stabilize

Bitcoin bounced back modestly to 86,944 after a sharp slide earlier in the week, but the crypto market remains jittery. Ethereum continued to edge down toward 2,808. The recent selloff in digital assets has been attributed to rising global yields and reduced appetite for high-volatility instruments.

The risk-off tone reflects growing concerns that aggressive central bank postures could dent liquidity and speculative flows. As bond markets recalibrate, crypto remains exposed to shifts in rate expectations and global monetary sentiment.

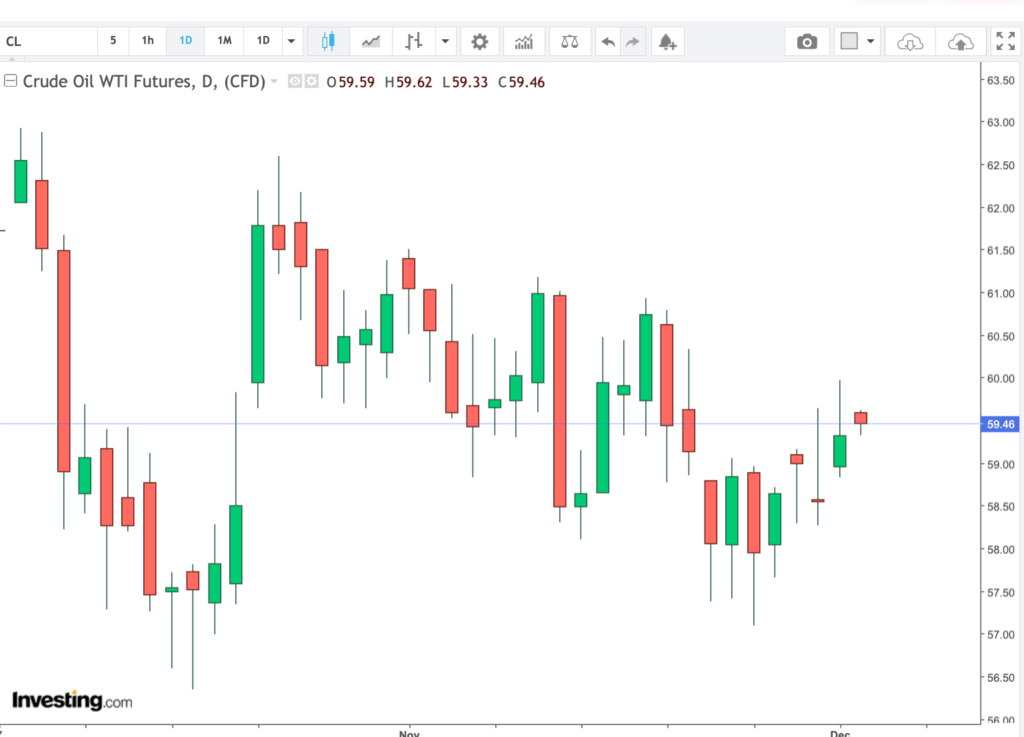

Gold Under Pressure, Oil Holds Ground

In commodities, gold retreated to 4,222 per ounce as firmer U.S. Treasury yields undercut demand for the non-yielding metal. The inverse relationship between gold and interest rates remained evident, with investors rotating toward income-bearing instruments amid higher yields.

Oil prices showed modest gains, with WTI crude trading around 59.40 per barrel. While that marks a slight rebound, crude remains near the lower end of its 52-week range. Traders are weighing global demand signals against the potential for supply-side disruptions, particularly heading into winter and year-end production decisions.

Macro Sentiment Shifts Toward Caution

The broader backdrop remains focused on rates and inflation signals. Global bond markets, including those in Asia and Europe, saw yields rise amid hawkish central bank commentary, leading to a defensive tone across asset classes. Equities and crypto have absorbed most of the pullback, while safe-haven assets continue to react to shifting macro expectations.

Markets now turn to a series of U.S. economic reports and central bank speeches expected later this week. These will likely set the tone for the remainder of the month and could determine whether investors continue rotating out of growth-sensitive assets.

What to Watch Next

- U.S. jobs data and service PMI figures due later this week could influence Fed expectations and overall market tone

- Bond market volatility remains key, further yield spikes may weigh on equities, gold, and crypto

- Oil traders should watch for signs of demand recovery or further inventory builds as crude trades near multi-month lows

Follow CG FinTech’s Media Center for more Expert Insights!

Forward Looking Statement Disclaimer

This document contains forward-looking statements, which can generally be identified by the words “expects,” “believes,” “continues,” “may,” “estimates,” “anticipates,” “hopes,” “intends,” “plans,” “potential,” “predicts,” “should,” “will,” or similar expressions. Such statements are based on CG FinTech’s current expectations and assumptions, but actual results could differ materially from those anticipated due to a number of risks and uncertainties. CG FinTech does not guarantee the accuracy or completeness of these statements and undertakes no obligation to update or revise any forward-looking statements.

Disclaimer

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any financial instruments. Trading Contracts for Difference (CFDs) and foreign exchange (forex) carries a high level of risk and may not be suitable for all investors. It is important to fully understand the risks involved and seek independent financial advice if necessary.

Leave a Reply