Market News – July 3, 2025

Markets were cautiously higher Wednesday as investors braced for a crucial U.S. jobs report and digested a slew of political and policy-driven headlines. From new trade deals and fiscal proposals to inflation signals and bond market jitters, the day was rich with cross-asset signals.

S&P 500 & Nasdaq Edge Higher Amid Trade Deal Optimism

The S&P 500 and Nasdaq both closed at fresh record highs midweek, as upbeat sentiment from a preliminary U.S.–Vietnam trade agreement—coupled with strong Apple, Tesla, Nike, and Nvidia activity—drove technology names forward .

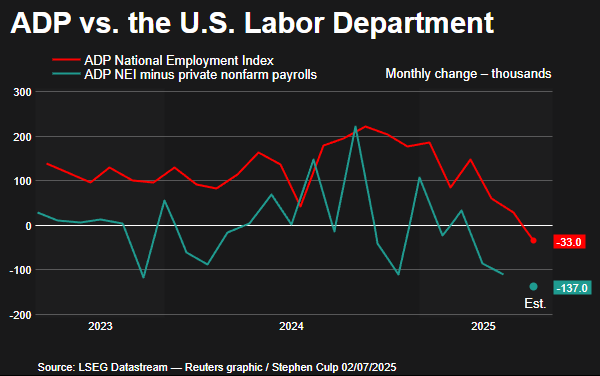

Despite the rally, Asian markets remained cautious ahead of the Friday nonfarm payrolls release, with private-sector jobs already showing weakness—a sign of potential labor market cool-off.

Trump’s Vietnam Deal: Dynamic Trade Shift

In what analysts call a quieter outcome than earlier tariff threats, the deal sets a 20% tariff on Vietnamese exports to the U.S., while U.S. goods retain zero tariffs. Shares in Nike and similar apparel manufacturers spiked on the news—a sign of relief in supply chain–sensitive sectors .

Asia-Pacific stocks followed suit, but U.S. futures remained flat—markets are hesitant until the deal’s details and tariff deadlines (like July 9) are clarified.

Oil Softens, Bonds Advance on Macro Concerns

After a sharp 3% rally on Tuesday—sparked by geopolitical tensions including Iran’s suspension of nuclear cooperation—oil prices backed off Thursday. Investors were spooked by signs of fading U.S. demand and looming tariff risk .

At the same time, Treasury yields eased, with the 10-year yield pulling back to around 4.27%, as investors recalibrated expectations around Fed policy and federal debt dynamics.

Dollar Weakness Supports Risk Plays

A softer U.S. dollar—trading near three-year lows—has helped prop up equities and commodities. The decline reflects dovish sentiment ahead of payrolls and the uncertainty surrounding Federal Reserve Chair Powell’s path amid trade volatility.

What’s Next: Payrolls, Tariffs & Fiscal Watch

All eyes now turn to Friday’s U.S. nonfarm payrolls, where expectations are for a 110,000 gain and a slight rise in unemployment to 4.3%. A weak report could bolster the Fed’s case for rate cuts later this year .

Markets will also monitor the July 9 tariff deadline, further developments on tax‑and‑spending proposals in Washington, and fresh remarks from Chair Powell—any of which could shift sentiment dramatically .

Investor Outlook

Market momentum holds, but optimism is fragile. Trade progress and a cooler dollar support risk assets, yet inaction by the Fed and possible labor-market softness could reverse sentiment quickly. Proceed with a balance of opportunity and caution.

Stay Informed with CG FinTech’s Media Center

For up‐to‐the‐minute analysis on global financial markets, trade policy, and central bank insights, follow CG FinTech’s Media Center. Clear, expert insights to guide your strategy.

Forward Looking Statement Disclaimer

This document contains forward-looking statements, which can generally be identified by the words “expects,” “believes,” “continues,” “may,” “estimates,” “anticipates,” “hopes,” “intends,” “plans,” “potential,” “predicts,” “should,” “will,” or similar expressions. Such statements are based on CG FinTech’s current expectations and assumptions, but actual results could differ materially from those anticipated due to a number of risks and uncertainties. CG FinTech does not guarantee the accuracy or completeness of these statements and undertakes no obligation to update or revise any forward-looking statements.

Disclaimer

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any financial instruments. Trading Contracts for Difference (CFDs) and foreign exchange (forex) carries a high level of risk and may not be suitable for all investors. It is important to fully understand the risks involved and seek independent financial advice if necessary.

Leave a Reply